Ok, let’s take a break from MDM acquisition madness and change topics.

Last year I reviewed the Info week startup 50 and noted that Approx. 40% of Information week’s Startup 50 are Cloud or Virtualization companies. It showed where the VC’s were putting their bets around what they perceived to be the next new wave. I also recently talked about the cloud strategy of public players like Informatica, showing that cloud computing is on the radar of the most innovative companies. In this post, I’m going to take a quick look at how companies I personally follow are doing, picking out my favorite 5. I’m calling it my cloud computing fantasy private company portfolio. Basically if I had some fantasy VC money to invest, here’s where I’d like to put my bets. Note that generally it’s a good idea to diversify your portfolio, so I’m also applying those principles here.

First my personal (with the emphasis on personal) top 5 favorites:

- Appirio – Best known for their tight relationship with Salesforce.com, Appirio has done extremely well both on the coattails of SFDC’s continuing success, but also in their own right. As the momentum for cloud computing accelerates organizations are actively seeking guidance around solutions and architecture. Appirio has done an excellent job of positioning themselves as thought leaders. As evidenced by their Cloud Computing predictions press release last Dec and their numerous high profile on stage demonstrations of new integrations in conjunction with SFDC’s major events. As well as offering products in the form of cloud connectors. I walked the floor of Dreamforce this year and Appirio’s booth (substantial in size by the way for a small company) was packed to the gills. If the cloud is the future, a new wave of SI’s like Appirio are poised to benefit greatly. Funding from Sequoia Capital, GGV Capital, salesforce.com, and a select group of angel investors

- Aster Data – I first blogged about Aster Data, the “Big Data, Fast Insights” company, last year when I attended a Cloud Computing SIG in which they, Cloudera (also a fav of mine) and Google presented. See Google App Engine, Cloudera and Aster Data – A trifecta of offerings for the Cloud. I continued to monitor the progress of the company together with their competitor Greenplum making observations respectively about their positioning strategies. Most recently on 2/18/10 I attended Aster Data’s Big Data Summit tweeting my observations.The Summit was very well organized and attended with some compelling customer case studies from Mint.com and Mobclix. The emphasis on a different paradigm for analytics for “Big Data” is really picking up momentum and Aster has an approach which is compelling to those organizations who aren’t willing to retrain and retool their programmers and DBAs. While there are other similar companies such as Vertica, Paraccel, Greenplum and more in a crowded but massive market, I most like what I’ve seen to date from Aster and due to diversification rules, I can only pick one. Funding from Sequoia Capital, Institutional Venture Partners (IVP), Jaffco Ventures, Cambrian Ventures, First Round Capital.

- Cloudera – One look at the Cloudera Team on their website tells you plenty about the talent and experience behind the company looking to bring Apache Hadoop into mainstream enterprise development. Last year speculation was rife about whether Cloudera, particularly with charismatic CEO Mike Olson’s was merely focused on a “Red Hat” play on Hadoop (see my quick primer) by essentially offering open source software for free in order to benefit from training, support and consulting. In a recent interview published on GigaOM Mike Olson clarified that “Either this quarter or next we will offer an enterprise software bundle consisting of proprietary enhancements for Hadoop users,”. Interest in Hadoop and Map Reduce technologies is reaching a fever pitch. Corporations are looking at the technologies that power large Internet scale apps like Facebook, Google and others. Although to be clear, many are also interested in such technologies for use within the enterprise, not just related to cloud computing (public or private cloud). With the team Mike’s assembled and his track record, I’d put a little of my fantasy money on Cloudera. Funding from Accel Partners and Greylock.

- Voltage Security – You may ask yourself, why I’m plugging Voltage? (pun intended). At first glance, Voltage, a provider of end-to-end data protection across the enterprise through patented encryption technologyseems an unlikely selection within my cloud computing fantasy portfolio. However, when you mention cloud everyone runs from the room screaming hysterically “OMG the security holes, what about the protection of the data!”. The reality is that “the cloud” or let’s just call it the Internet requires that a lot of data be transmitted and moved around, a lot of it highly confidential. So how do you secure data, at rest or in motion? Voltage has all the tools to accomplish this task and they are significant thought leaders as evidenced by my post highlighting their unique Security Breach Index. While Voltage’s main successes to date have been with organizations focused on securing their enterprise, emails, ecommerce or payments data, let’s just say I have a few VC fantasy dollars betting that as more ISVs move to the cloud, Voltage products like their encryption key management and serving technologies will garner increasing interest. Funding from Hummer Winblad Venture Partners (Notably Ann Winbladon the board), Morgenthaler Ventures, Menlo Ventures and Trident Capital.

- Zuora – Blazing the trail in SaaS subscription billing and payments is capitalizing on the growing number of companies entering cloud computing and offering SaaS. Zuora (who’s name is a combination of characters from the last name of co-founders Tien Tzuo (CEO) and K.V Rao (Chief Strategist) state eloquently that just as Amazon makes it easy to become an online retailer, Google makes it easy for anyone to advertise online, and PayPal makes it easy to accept online payments, Zuora makes it easy for any company to build, manage, and grow a subscription business. Tien Tzuo is the former star CTO of Salesforce.com and Marc Benioff just happens to have a little personal investment of his own in the company. I anticipate Zuora’s momentum will continue and it wouldn’t surprise me if at some point SFDC decided that Zuora would be a perfect complement to their complete Force.com PaaS ecosystem, by offering billing and payments soup to nuts as well. So I’d be an investor here with my fantasy VC money. Funding Benchmarkand Marc Benioff.

There you have it, that’s my 5. I’m sure you have your favorites. Drop me a line if you think there are companies I should also look at putting my fantasy VC money into. Now please excuse me while I hop on my private jet to my Fantasy Island (It’s Da Plane!), thanks as ever for reading, hope you are having a great weekend.

Cloud ‘N Clear Poll – You Make The Call!

POLL HAS CLOSED: FRIDAY 2/26 7:00am PST! And the winner is …

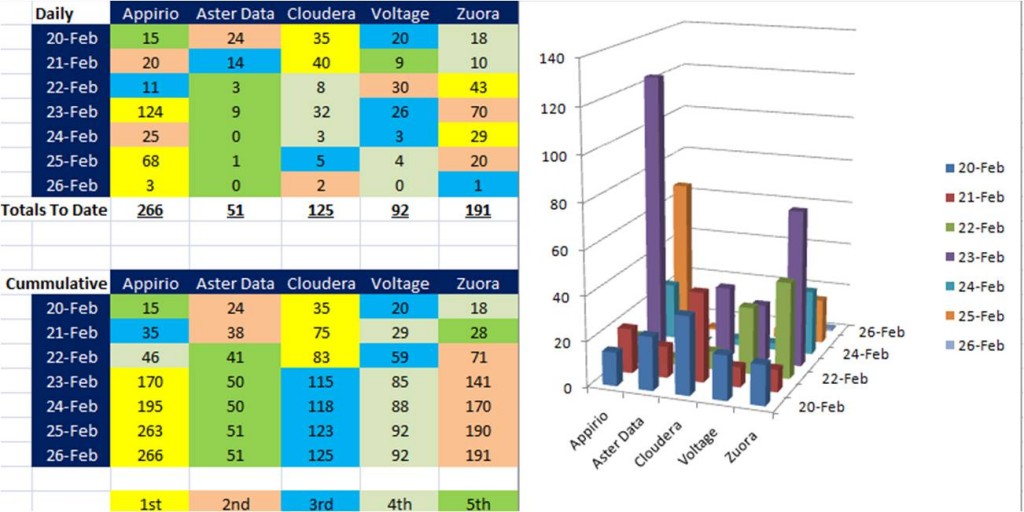

It was a close race with Cloudera bolting out of the gate, holding the lead through 2/23, then Appirio’s loyal group of followers and fans woke up. After that Zuora made a valiant effort to keep pace, but like Seabiscuit, Appirio continued to pour it on and in the end it was no contest. Their activity on Twitter is tapped into their large following also since they recently got lots of votes at another contest they had voters ready to go! Zuora’s marketing is kept them in the game, with good tweeting and even using Digg!, but in the end Appirio was too much.

It was a close race with Cloudera bolting out of the gate, holding the lead through 2/23, then Appirio’s loyal group of followers and fans woke up. After that Zuora made a valiant effort to keep pace, but like Seabiscuit, Appirio continued to pour it on and in the end it was no contest. Their activity on Twitter is tapped into their large following also since they recently got lots of votes at another contest they had voters ready to go! Zuora’s marketing is kept them in the game, with good tweeting and even using Digg!, but in the end Appirio was too much.

Votes came from all over the world for all companies (see geo map at the end of the post) so this wasn’t just “friends and family”. There was genuine interest in all 5 companies, and I received quite a few DMs and emails from readers excited about the outcome and telling me that they were looking forward to reviewing and understanding these companies in more depth. All companies have even started appearing on FollowFriday lists #FF, now that’s finding net new fans (and maybe some new customers)!

Once more this is a great testimonial to the wide appeal of Twitter (which I recently reviewed) whereby a simple blog post such as mine could garner well over 2600+ views in a span of just 6 days with over 25% (600+) proactively voting for their favorites.

Thanks everyone for reading and participating. It was fun! The grand prize as I had mentioned will be … drum roll … an in-depth review of Appirio in a future post. Stay tuned.

Your Votes: [poll id=”8″]

FINAL GRAPH As of 2/26 7:00 am PST

Visitors to this post since it was published shows geographical distribution of voters.

One thought on “Cloud Computing Fantasy Private Company Investing – Appirio, Aster Data, Cloudera, Voltage Security, Zuora”